Natural hydrogen, an abundant, yet largely untapped resource, has the potential to transform the global energy landscape, offering clean fuel at a fraction of today’s costs and emissions. But unlocking this promise requires not only scientific rigour, but also an execution-focused approach that leverages best-in-class exploration methods.

AP Ventures is pleased to announce its investment in Paris-based Attributes’ Seed Round. Attributes’ digital infrastructure for energy commodities marks an important milestone in bringing more transparency to energy markets.

AP Ventures is proud to support the MIT Climate and Energy Prize for a second year after a positive experience in 2024. In March, Senior Investment Manager, Alexis Garavel, attended the semi-final as a judge in Munich to hear pitches from international start-ups competing for the prize, and the finale takes place this week!

Noble Gas Systems announces the first close of its Series B round. AP Ventures participated in the round alongside ALIAD (Air Liquide Venture Capital) and NOVA by Saint-Gobain to support Noble Gas as it grows to deploy its novel gas storage solution.

AP Ventures is pleased to announce its investment in California-based Mitico’s Seed Round. Mitico’s granulated metal carbonate (GMC) sorption technology is a promising approach to industrial point source carbon capture.

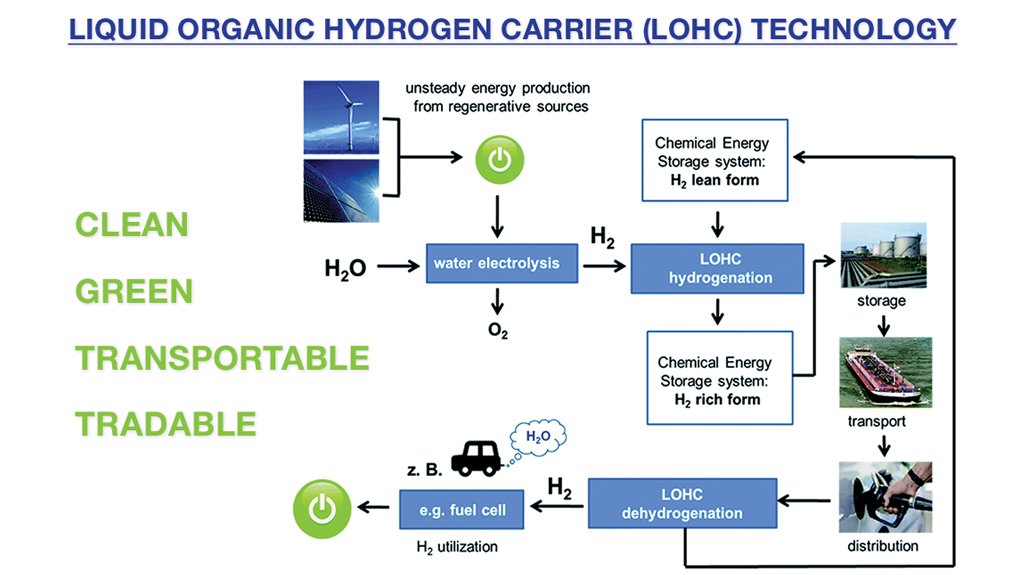

AP Ventures is pleased to continue its support for Hydrogenious LOHC Technologies in its latest fundraising round alongside Limited Partners Temasek and Anglo Platinum Marketing Limited, as well as co-investors Winkelmann Group, Covestro and Chevron Technology Ventures.

Infinium announces the close of the first tranche of its Series C fundraise. AP Ventures participated in the round led by Brookfield Asset Management.

Amogy announces a successful fundraise of USD 56m to support the team to continue to scale its carbon-free ammonia-powered systems. AP Ventures participated in the round, led by Aramco Ventures and SV Investment.

Ahead of the inaugural Houston Energy + Climate Startup Week, the AP Ventures team sat down with Roslynn Velasquez and Matt Peña from the Rice Alliance to hear about why Texas is a great place to start and grow a cleantech venture, how Rice Alliance supports these startups, and other exciting cleantech developments in Texas. We also spoke with AP Ventures’ portfolio company Amogy on why it chose Texas to build its ammonia-to-power clean energy technology there.

AP Ventures is pleased to announce its investment in Aether Fuels. Aether’s flexible technology enables the conversion of a wide range of waste carbon feedstocks into jet fuel and other liquid hydrocarbons.

AP Ventures’ Kosuke Kobayashi and Brandon Zhanda sat down with the managing team of MIT’s Climate & Energy Prize (CEP), Daniel Capelin, Tohori Tsuchiya, and Ryota Shoji to talk about the history and challenges of the initiative, as well as its promising future.

AP Ventures is pleased to announce its investment in Airhive, alongside co-investor Coca-Cola Europacific Partners. Airhive’s low-cost, energy-efficient and rapidly scaleable direct air capture technology has the potential to support the achievement of global warming and net-zero targets.

AP Ventures is pleased to announce its investment in Immaterial Ltd. alongside co-investors SLB, CEPSA, Chevron Technology Ventures, JERA Inc., Energy Revolution Ventures, TriREC and Ultratech Capital, in addition to existing investors. Immaterial’s monolithic metal-organic frameworks technology has the potential to create solutions for multiple application areas of industrial decarbonisation, including carbon capture and hydrogen storage.

On Sunday 16 July, AP Ventures celebrated 5 years as an independent fund manager.

Amogy, a pioneer of emission-free, energy-dense ammonia power solutions, today announced its USD 139m Series B-1 fundraising.

Follow our team on the Southern African hydrogen stage

The Series A funding was led by AP Ventures, with participation from Australia-based Fortescue Future

The funding round led by AP Ventures brings together a consortium of investors including Aramco Ventures and True

Series B funding round co-led by AP Ventures and Mitsubishi Corporation

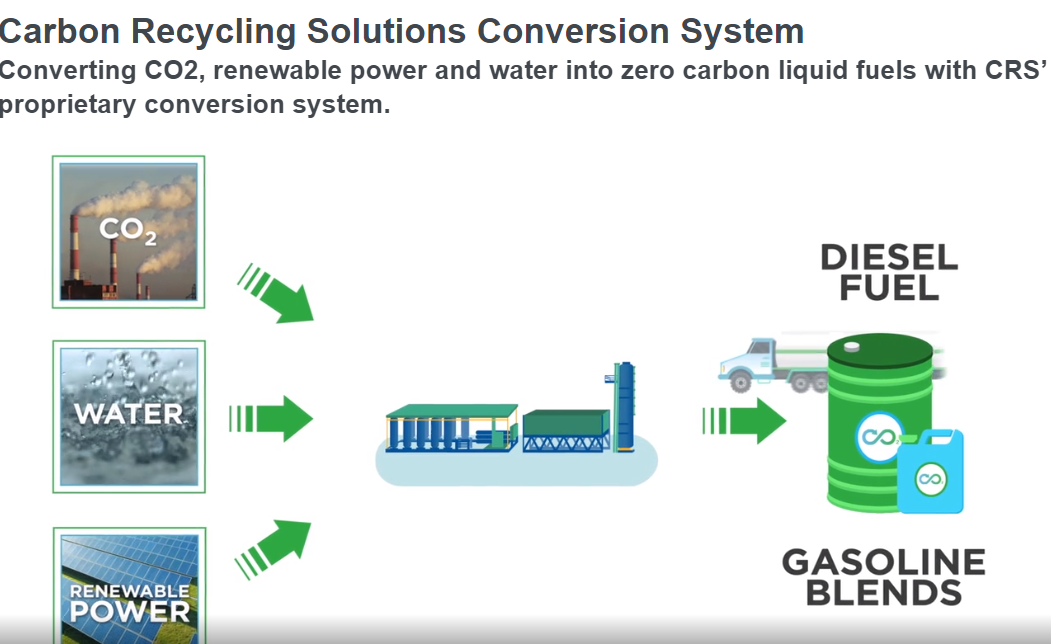

Special Presidential Envoy for Climate, John Kerry, and Ukraine Minister of Energy, German Galushchenko, announced at COP 27 their cooperation on a Ukraine Clean Fuels

Read the summary below!

Portfolio company update enclosed.

Portfolio company update.

World hydrogen congress highlights.

Amogy’s proprietary ammonia-to-power system will be considered for future shipping projects with Yara Clean Ammonia (YCA) and external partners.

Groundbreaking sustainable ammonia company continues rapid advancement towards mass commercialization

AP Ventures was invited to present at this years’ LMBA / LPPM conference in Lisbon

Hypermotive has been developing a portfolio of products and services to accelerate the development of the next generation of zero-emission transportation technologies

AP Ventures joined members of the aviation industry for the Farnborough International Air show.

Investec podcast summary

Exciting announcement from one of our portfolio companies!

New portfolio company update!

New portfolio company update!

We are delighted to announce our presence at the Hydrogen Americas Summit on 10-11 October 2022 in Washington, D.C.

Portfolio company Amogy features in Crain’s New York Business article

AP Ventures join SK Innovation, Climate Pledge Fund, Saudi Aramco Energy Ventures & Newlab in bridge funding round.

Exciting update from our portfolio company Amogy, click to read more.

JP Morgan Global Hydrogen week summary

Click to read more about Anglo American's new launch!

AP Ventures join SK Gas, Breakthrough Energy Ventures, Eni Next and Mitsubishi Heavy Industries in $34 million financing round for C-Zero’s first pilot plant.

AP Ventures lead Noble Gas Series A funding round to support the development of its conformable high-pressure hydrogen storage technology.

AP Ventures leads NOK 170 million series A fundraise into Hydrogen Mem-Tech.

Mining Weekly's Martin Creamer shares highlights of PGM Industry Day panel discussion, chaired by AP Ventures' Partner Kevin Eggers.

AP Ventures leads the investment round into Fairbrics to support the decarbonisation of the fashion industry using CO2 and green hydrogen.

Kevin Eggers, shared his views on the future of energy and the role hydrogen will play with the FT’s Partners Studio podcast “The Next Five”.

Electrofuels Innovator Infinium™ Announces Strategic Partnership with Industry Leader ENGIE for One of the Largest Announced Commercial Scale E-fuels Facilities in Europe

AP Ventures invests into EH Group to advance its zero-emission fuel cell technology.

AP Ventures leads the investment round to support commercialization of Amogy’s innovative ammonia-based power technology, joined by Amazon

New investors Alaska Airlines and United Airlines join existing investors AP Ventures, Amazon’s Climate Pledge Fund, Breakthrough Energy Ventures, Horizons Ventures, Summa Equity and Shell Ventures in the round.

Amazon and NextEra Energy co-lead investment round to help bring Infinium Electrofuels™ to market

Led by JERA Americas, alongside Temasek, with AP Ventures, Chevron Technology Ventures, Pavilion Capital, Royal Vopak and Winkelmann Group also participating, the round will be used to deploy commercial systems into landmark projects around the globe.

ZeroAvia expands its hydrogen-electric aviation program to 19-seat aircraft and raises additional $13m for large engine development.

Temasek is the latest LP joining AP Ventures Fund II

Amogy's funding round includes San Francisco based funds DCVC and Collaborative Fund, and investor Shaun Arora alongside AP Ventures

Nysnø Climate Investments, Equinor Ventures and Yara Growth Ventures are the first Norwegian Limited Partners in AP Ventures

AP Ventures welcomes Pavilion Capital as a new investor into Fund II

AP Ventures leads major funding round for Starfire Energy.

AP Ventures leads investment into innovative PEM electrolysis technology that materially reduces the energy required to produce green hydrogen.

Kathrine Ryengen, CEO of ZEG Power, talks to Sifted.eu hydrogen production and integrate carbon capture.

A new company which is being established in South Africa is looking for a highly motivated and energetic Business and Market Development Senior Manager.

Round was co-led by Breakthrough Energy Ventures and Eni Next, with participation from Mitsubishi Heavy Industries and AP Ventures

Hydrogen-Refueling-Solutions achieves record IPO for EuroNext Growth Paris and is 5.7x oversubscribed.

Anglo American partners with 10 other companies to form a new initiative focused on advancing hydrogen development called “Hydrogen Forward”.

Infinium closes funding to decarbonize transportation sector with electrofuels solution

The Everything About Hydrogen Team dig into the mining industry with Jan Klawitter of Anglo American in their latest podcast

We look into hydrogen production and unpack trends in green and blue hydrogen

Funds will be used for engineering and design of Starfire’s modular 50 tonne per day green ammonia production system

AP Ventures welcomes Implats as a significant new investor and Advisory Board Member

Funds will be used for scale up and market expansion of HPNow’s autonomous on-site hydrogen-peroxide generation technology solutions

In an online conference featuring the company's leadership, Plastic Omnium presented its strategic view on hydrogen mobility

Insplorion raises SEK 60.3m to accelerate the development of its hydrogen and battery sensors, and to facilitate further commercialisation of air quality sensors

Sumitomo Corporation joins Anglo American Platinum, the Mirai Creation Fund, Mitsubishi Corporation, Plastic Omnium and the Public Investment Corporation as an investor in AP Ventures.

Hazer Group Limited and AP Ventures have executed a non-binding term sheet for an investment in Hazer by APV.

Written by Charlie Clark, one of our Investment Associates, the article highlights how disruptive we believe LOHC and Hydrogenious can be, and how together they can establish hydrogen as a globally traded commodity.

Enova has awarded a joint project application from ZEG Power & CCB NOK 77m to deploy a blue hydrogen demonstration plant on the west coast of Norway.

Kevin Eggers interviewed with Mining Weekly after Germany specifically included hydrogen in its economic recovery plans.

AP Ventures have contributed comments on the growing levels of interest and traction in Hydrogen

AP Ventures will ramp-up its presence in South Africa to help unlock value from this dynamic emerging market.

Mining majors are putting the spotlight on hydrogen once again with the launch of the Green Hydrogen Consortium.

ZEG Power raises NOK 130m to deploy its zero-emission hydrogen production technology

Andrew Hinkly, our managing partner, participated in a webinar on hydrogen finance and investment organised by Green Power Global.

Greyrock Energy hosted a panel at last week’s Cleantech Conference in San Francisco discussing Power-to-X technologies and commercialization.

Hydrogenious LOHC Technologies successfully concludes its fundraising round adding €3.5m to the €17m secured from other strategic investors in July.

AP Ventures provided their views in the Mining Weekly special report on fuel cells and hydrogen.

AP Ventures today announces that Compagnie Plastic Omnium (‘Plastic Omnium’) has become a Limited Partner and Advisory Board Member in AP Ventures Fund II following their commitment of $30 million in the fund.

Vopak, Mitsubishi Corporation, Covestro and AP Ventures invest €17m into Hydrogenious LOHC Technologies and its LOHC technology for hydrogen logistics

The event gathered attendees from portfolio companies, corporates, investors and industry experts.

AP Ventures welcomes the Mirai Creation Fund II as a new investor

Andrew Hinkly, Managing Partner of AP Ventures, participates in the Hydrogen Council G20 Investor Forum, in Karuizawa, Japan

A key step in the development of the French start-up which inaugurates its first compact H2 production and storage station on June 19th

Advanced technology fund sees rapidly expanding opportunities in flare gas transformation and rising demand for clean-burning fuels

AP Ventures hosts a workshop on the role of VC in the rise of H2 economy

ERGOSUP raises €11 million to deploy its green hydrogen production and storage infrastructure

Morrisons is set to trial a new film packaging technology developed by food tech firm It’s Fresh! to prolong the life of fresh produce.

Mitsubishi Corporation joins as an investor in AP Ventures, alongside Anglo American Platinum and The Public Investment Corporation

Three founders of Hydrogenious Technologies GmbH: Prof. Wolfgang Arlt; Prof. Peter Wasserscheid; and Dr. Daniel Teichmann have been nominated for the “Deutscher Zukunftspreis”, the German President’s Award for Innovation in Science and Technology 2018. The nomination recognizes the ground-breaking research and development achievements of the scientists in the field of hydrogen storage and its successful commercial implementation as an important contributor to a future sustainable energy system. The “Deutscher Zukunftspreis” will be awarded by the President of the Federal Republic of Germany, Dr. Frank-Walter Steinmeier, in Berlin on November 28th, 2018.

Andrew Hinkly attended the International Hydrogen Fuel Cell Vehicle Congress 2018 in Rugao, China, and chaired the Market and Capital Investment session co-organised by Anglo American and the China Society of Automotive Engineers (SAE).

AP Ventures @ New York Platinum Week 2018

London, United Kingdom, 17 July 2018: AP Ventures today announces its launch as an independent venture capital fund to invest in applications for Platinum Group Metals (PGMs). Anglo American Platinum and South Africa’s Public Investment Corporation (PIC), as cornerstone investors, have each committed US$100 million to AP Ventures.

The unit will invest in hydrogen technologies such as fuel cells, as the world’s biggest producer of platinum seeks to boost demand for the metal.