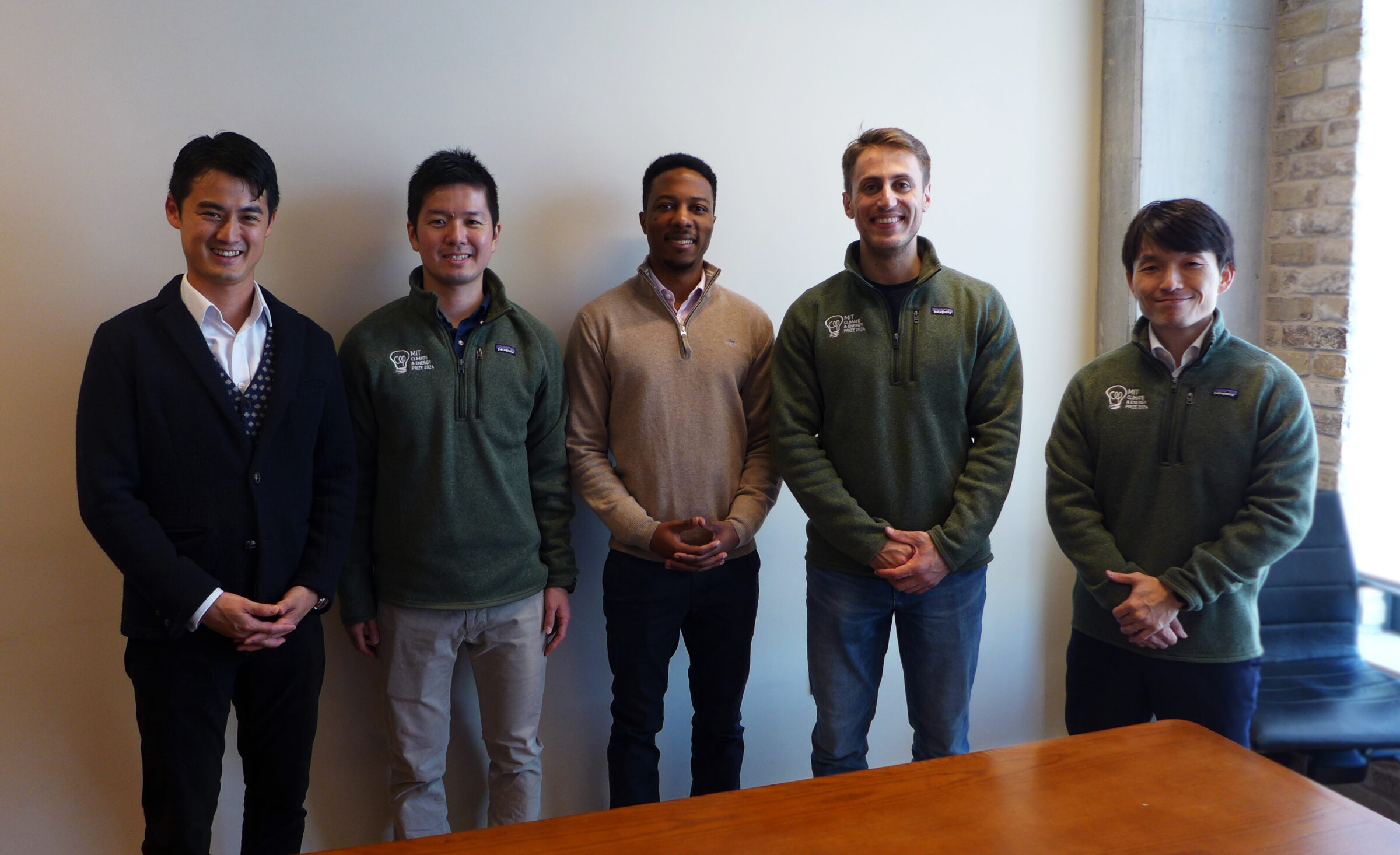

AP Ventures’ Kosuke Kobayashi and Brandon Zhanda sat down with the managing team of MIT’s Climate & Energy Prize (CEP), Daniel Capelin, Tohori Tsuchiya, and Ryota Shoji to talk about the history and challenges of the initiative, as well as its promising future.

MIT's Climate & Energy Prize has grown significantly over the past 17 years, nurturing startups that are making a significant impact in the clean energy sector. Our conversation touched on the importance of mentorship, partnerships and collaborations in supporting university-based startups. We also explored the key role of the venture capital community in making the prize a success.

AP Ventures is delighted to be sponsoring this exciting and important competition. We recognise the critical need for capital and industry support for startups as they make the transition from university. As part of our sponsorship, AP Ventures will share our extensive knowledge and expertise in the climate sector, as well as our experience supporting startups as they spin out of universities.

APV: What is the history of the Climate & Energy Prize and how has it evolved over the years?

Daniel: MIT's CEP has evolved significantly since it was established by Tod Hynes, an MIT lecturer, who recognised the need to support university startups on a larger scale. Initially funded by just two sponsors and structured as a prize-based program, CEP has expanded over its 17-year history. What began as a simple prize has grown into a comprehensive ecosystem offering more than just funding; CEP now offers mentorship, connections and boot camps to help startups navigate the challenges they face.

In recent years, CEP has expanded internationally and diversified its programme. In addition to providing prize money and memberships, CEP now hosts events like Industry Insights Week, where startups can connect with industry sponsors and receive valuable feedback on their pitches. This broader approach has contributed to the success of numerous startups that have emerged from the program.

Tohori: Over the past seven years alone, CEP has seen over 220 startups emerge, with more than 80% still operating. These startups span various industries, from solar energy to SaaS platforms, with notable success stories like SES, a company specialising in lithium-metal batteries, which raised over $600 million before its IPO.

APV: How do you engage with the VC community? Any difference between generalist VCs and specialist VCs?

Daniel: Venture capitalists play a crucial role in our ecosystem, extending far beyond just financial support. Their attendance at each stage of the prize is significant, as many participants look for VC support not only for capital but for the invaluable connections and networks they provide. Even in cases where startups don’t progress through the various stages of the competition, the relationships forged with VCs through the process continue beyond the program.

We see some key differences between generalist and specialist VCs. The specialised insights offered by industry-focused VCs is particularly helpful to startups, and the generalist VCs can often provide broader networks. Unlike the generic guidance provided in conventional startup boot camps, specialist VCs offer tailored expertise and deep industry knowledge. This specialised lens is invaluable when navigating complex scenarios, such as securing funding for high-capex projects, where a detailed sector understanding is key.

APV: What are some of the challenges?

Daniel: Our leadership team has identified two main challenges this year: bandwidth constraints and managing growth within these limitations. With a team comprising 22 students, each pursuing their MBA alongside various commitments, setting priorities becomes difficult, especially within a group of this size.

To address these challenges, we made sure to define our objectives clearly, identifying areas where we can streamline our efforts. However, scaling our initiatives while accommodating the diverse needs of our team remains a formidable task. In this regard, strategic partnerships have proven invaluable, allowing us to leverage the collective networks and resources of our partners and sponsors.

Our other challenge is growth. We had so much success in the US, and we want to open up the program to the rest of the world. Our partnership with the London Business School has been instrumental this year in enabling us to expand our reach; we would like to replicate similar partnerships elsewhere, but establishing a presence in global hubs remains challenging, as our team is primarily US-based.

Tohori: This is the second year doing the event internationally. Last year was focused more on Europe and US, but this year, we really tried to open it up to Asia and other parts of the world.

APV: What can the VC community do more to support this initiative?

Ryota: There are several collaborative initiatives on which we are working; one is centering around mentorship. While we already pair semi-finalists with mentors, we recognise the additional value mentorship can bring. Mentors can offer not only deep technical expertise but also insights as seasoned investors;many startups entering the program this year expressed uncertainty of the market value of their technologies, and mentors with a sector focus are able to advise.

Tohori: Building upon this theme, in collaboration with our longstanding sponsors, we recently introduced Industry Insights Week. This initiative had positive feedback from our participants, providing them with firsthand insights into various sectors, such as the hydrogen value chain. Exploring opportunities to co-create content and events with industry stakeholders further adds to the educational component of the CEP initiative, offering startups exposure to diverse industry perspectives.

Finally, tapping into the network of VCs presents avenues for expanding our reach and impact. By fostering stronger ties with VC communities, we can increase our prize offerings, empowering more startups who participate in the program. Also, the VCs with which we partner often have a global footprint and relationships with universities around the world – in the future we can engage with this network to expand the program further.

APV: Tell us a little bit about yourselves and why you are where you are today

Daniel Capelin (Managing Director):

Prior to business school, I was in Denver, Colorado designing medical devices and driving engineering changes. Nature and outdoor activities have been my long-time passion, and I decided to go to business school to pursue a career where I can leverage my technical background with my passion for climate. During my time at MIT, I honed in on climate technology and entrepreneurship, spending my first year familiarising myself with the ecosystem, delving into climate tech, and grasping the fundamentals of entrepreneurship and team building. As I progressed into my second year, I sought opportunities to engage meaningfully in both climate and technology. Amidst various options at MIT, the Climate & Energy Prize stood out as a bridge between academia and industry, offering a platform to witness firsthand how university startups navigate scaling challenges and contribute to ecosystem development.

Tohori Tsuchiya (Managing Director):

I was trained as an engineer, but began my professional career in banking, focusing on energy and infrastructure space. During that time, I encountered a pressing need to integrate new emerging technologies for sustainable infrastructure, which prompted me to pause and go back to academia and develop a deep understanding of technology innovation and scale-up. MIT, with its abundant resources and robust programs, was an obvious choice. Throughout my time at MIT, I was struck by the breadth of resources available, but I was particularly drawn to the Climate & Energy Prize, which uniquely serves as a conduit between academia and external industry players.

Ryota Shoji (VP of Sponsorship):

Before my MBA, I spent many years in supply chain management. The concept of sustainability was acknowledged but often overshadowed by cost concerns for our suppliers. It wasn't until I pursued my MBA at HBS that I truly appreciated the pivotal role sustainability plays in reshaping business dynamics. This revelation sparked my interest, prompting me to explore ways to deepen my involvement. It was during my second year of university that I discovered an exciting opportunity across the river at MIT, and decided to join the CEP initiative.