AP Ventures is proud to support the MIT Climate and Energy Prize for a second year after a positive experience in 2024. In March, Senior Investment Manager, Alexis Garavel, attended the semi-final as a judge in Munich to hear pitches from international start-ups competing for the prize, and the finale takes place this week! It was great to see one of the companies we are mentoring, Ventrix Labs, a UK-based DAC company, make it through to the finale.

Ahead of the finale, we sat down with the organising team, May Robison, Elizabeth Stasior and Carl Becker to learn more about the prize, the trends and themes of the year, and how startups and VCs are working together to support climate solutions.

Please introduce yourself and what motivates you to be part of the MIT CEP organising team

May Robison: I am a first year MBA at MIT Sloan and am deeply committed to supporting early stage climate technologies and entrepreneurs. I am one of the VP’s of Sponsorship for the Climate & Energy Prize, and in this role am responsible for raising capital and interfacing with the sponsors that make this prize possible. I am particularly excited to be a part of the team because of the opportunity to get to know future leaders in the industry.

Elizabeth Stasior: I am a second year MBA at MIT Sloan and am motivated to support early-stage founders working on the next generation of climate and energy technologies. I’ve seen how difficult it is to translate breakthrough innovations from lab to market, and I’m passionate about helping entrepreneurs access the resources, capital, and community they need to cross that gap. I helped lead two CEP resource weeks this year, connecting student teams with investors, accelerators, and corporate partners to accelerate commercialization.

Carl Becker: I am a startup and venture capital enthusiast, deeply involved in the entrepreneurship scene at MIT. Originally from Germany, I am currently a second-year MBA student at MIT Sloan. My passion for climate and energy began early, leading me to graduate with a master’s degree in electrical energy technology. This academic foundation, combined with my enthusiasm for entrepreneurship, has shaped my career. Over the years, I have mentored multiple startups, helping them navigate challenges and achieve growth. The combination of climate and entrepreneurship brought me to MIT CEP, where I focused on all things startup and helped participants navigate the competition.

What is the MIT CEP?

The MIT Climate & Energy Prize (CEP) is the largest and longest running university climate and energy competition, founded 17 years ago and providing over $100,000 in prizes annually. CEP is open to early-stage, student-run climate and energy startups with less than $100,000 in dilutive funding and at least 50% student leadership.

The prize has nine climate tracks: energy, transportation, industrial decarbonization, food and land use, GHG capture and removal, climate services and software, built environment, water resources, and climate adaptation. Although the prize is based at MIT, we attract student teams from top institutions around the world, this cycle receiving over 160 applications from 40 different countries.

This year, we hosted two Semi-Finals and will host our Final on April 18. We are very lucky to have hosted our international Semi-Final with the Technical University of Munich (TUM), whose partnership enabled deep engagement with the European climate tech ecosystem.

How was the engagement with the VC community in the past months?

In 2025, we’ve been fortunate to receive outstanding support from leading professionals and companies driving climate and energy innovation. Our sponsors include global investors such as AP Ventures, Temasek, and Rose Rock Bridge, as well as major corporations like Chevron, Equinor, and Mitsubishi. We’ve also seen incredible engagement from over 35 venture capital professionals who have contributed as mentors, judges, and attendees. This strong support from the VC community gives student entrepreneurs the chance to gain feedback, build connections, and learn directly from experienced industry leaders. At the same time, investors gain access to a phenomenal pool of entrepreneurs. We have heard multiple CEP alumni receive their first-check from a mentor or member of the audience!

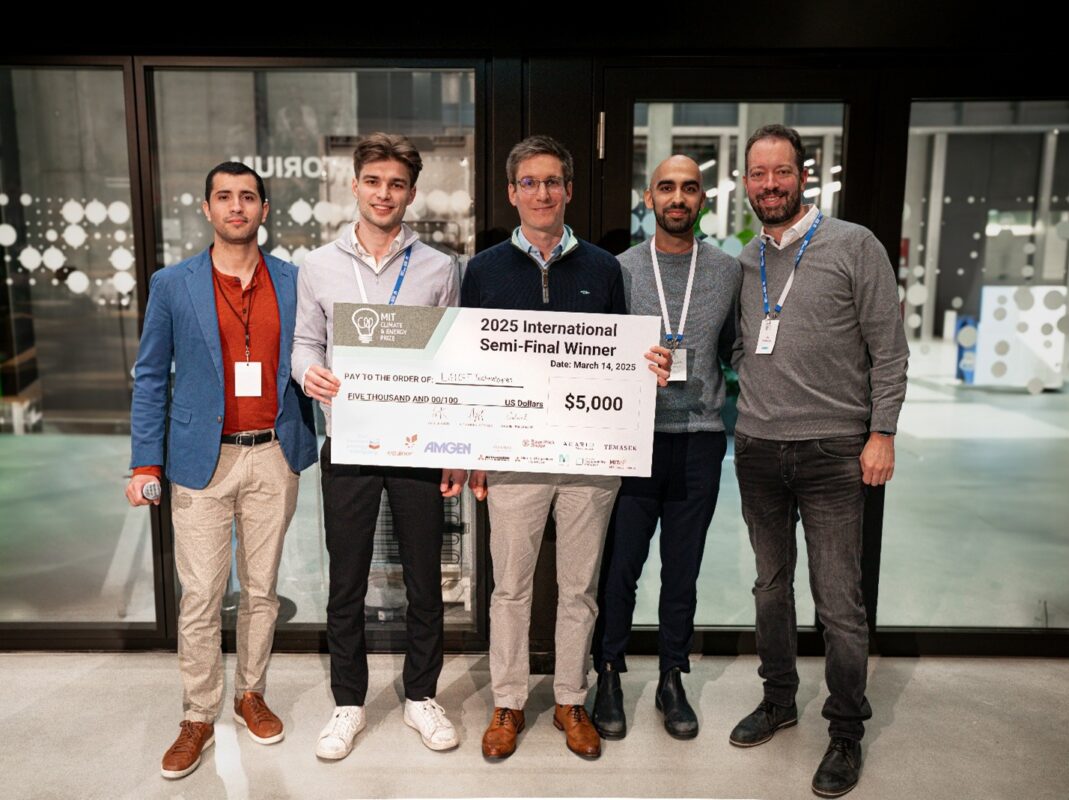

AP Ventures giving the prize to the International Semi Final Winner in Munich

Regarding the startups who joined the competition, what are the most prominent themes in this year’s competition and what’s exciting in this space?

Across this year’s applications for the MIT Climate & Energy Prize, certain domains stood out as particularly prominent. Among them, the circular economy and waste management emerged as a key focus area, with startups innovating to transform waste into value-added products. For instance, semifinalists like UpcycleX are pioneering zero-CO₂, zero-waste plastic upcycling via electrocatalysis, while ALBON is working on converting CO₂ and wastewater into fertilizers. These solutions reflect a growing global consensus that waste should not simply be discarded but repurposed to address resource scarcity and environmental challenges. This shift is driven by the increasing urgency to tackle pollution and its impacts on ecosystems and human health.

Energy generation and transportation remain strong themes, similar to previous years. However, this year has seen notable advancements in energy storage technologies, such as ECCubed, which focuses on concrete-based energy storage for sustainable infrastructure. Additionally, nuclear power has gained traction as more startups explore innovative approaches like Polygon Power, which is developing ultra-compact and safe nuclear reactors.

Despite economic and political headwinds, decarbonization continues to be a priority area for many companies. Startups like Solvanic are advancing flexible point-source carbon capture using electrochemistry, while Ventrix Labs is developing ultra-low-energy decentralized carbon capture systems. These efforts highlight the resilience of climate-focused innovation in addressing emissions reduction.

Geographically, there is a clear split between startups from developed and developing countries. Many U.S.-based startups are focusing on cutting-edge technical innovations, including nuclear power and chip-cooling technologies. In contrast, startups from developing countries are prioritizing local adoption, practical solutions, and decentralized technologies. This reflects differing regional challenges and opportunities: while U.S. companies often emphasize technological innovation in established industries, startups from developing regions are addressing pressing local needs such as energy access and waste management.

In your view, what types of support structures are currently available to these startups to help them progress to the stage where they're ready for VC investment?

While support for early-stage climate and energy startups is expanding, the path to venture capital readiness remains difficult to navigate. Programs like The Engine, Activate, and Greentown Labs offer critical early infrastructure and community, yet many startups struggle to evolve from scientific proof-of-concept to a venture-backable business. Most university-affiliated and grant-based programs are designed to advance technical milestones—not the commercial benchmarks VCs prioritize, such as demonstrated market demand, capital efficiency, and a credible go-to-market strategy. More targeted support is needed at this critical inflection point: tailored coaching, early market validation, and catalytic resources that align with venture timelines and expectations. These are essential to help deep tech ventures bridge the gap between research and private investment.

To help address these challenges, our team organized two resource weeks through the Climate & Energy Prize, designed to equip early-stage teams with the tools and insights required for VC engagement. Programming included a tech-to-market workshop with The Engine Accelerator, investor perspectives from Engine Ventures, and a strategic partnerships panel featuring Chevron and Equinor. We also introduced teams to leading incubators such as Greentown Labs and Rose Rock Bridge, and offered hands-on sessions focused on refining pitches and developing compelling business models.

What excites you for the year ahead?

May Robison: It’s all too easy to feel pessimistic or indeed panicked about the pace of climate action, particularly this year in the US as federal government support waivers. What allows me to remain optimistic is meeting the incredibly talented and resilient individuals working on innovative solutions in the face of this challenge. I feel fortunate to have met many of these entrepreneurs through the Climate & Energy Prize.

Elizabeth Stasior: What excites me most is the growing momentum around deep tech climatetech—especially within ecosystems like The Engine and Greentown Labs. Startups are tackling tough challenges like fusion, thermal storage, sustainable materials, and grid resilience, with the potential to decarbonize heavy industry and transform energy systems. I’m equally energized by bold state-level leadership—particularly in Massachusetts, New York, and California—where policies like the Mass Leads Act and NYSERDA’s support for demonstration projects are creating the policy and funding environments these technologies need to scale. These states are showing how public investment and smart regulation can catalyze private-sector innovation and accelerate real climate impact.

Carl Becker: Despite the current headwinds, the climate and energy space continues to show remarkable momentum. The challenging environment is prompting entrepreneurs to prioritize unit economics, accelerate commercialization timelines, and adopt lower burn rates. This shift is driving the industry toward solutions that can be deployed more rapidly, achieve higher market penetration, and generate climate impact at a faster pace. As a result, these pressures are not only fostering innovation but also contributing to the maturation of the broader climate and energy sector.